Carrollton: (972) 242-5700 | Garland: (972) 271-8700

Reliable Accounting and Bookkeeping Services in Carrollton & Garland, TX Get Started

For many people, tax season is stressful and an inconvenience. Waiting to file your taxes until the last minute and continuing to put them off is unproductive and will likely cause even more stress....

January 15, 2019 4th Quarter 2018 Estimated Tax Payment Due April 15, 2019 Individual Tax Returns Due for Tax Year 2018 Individual Tax Return Extension Form Due for Tax Year 2018 1st Quarter 2019 Estimated....

Did you or someone you know receive a letter from the IRS indicating that your tax return has been selected for audit? Each year, IRS audits over 1 million tax returns. With agency resources shrinking, the IRS....

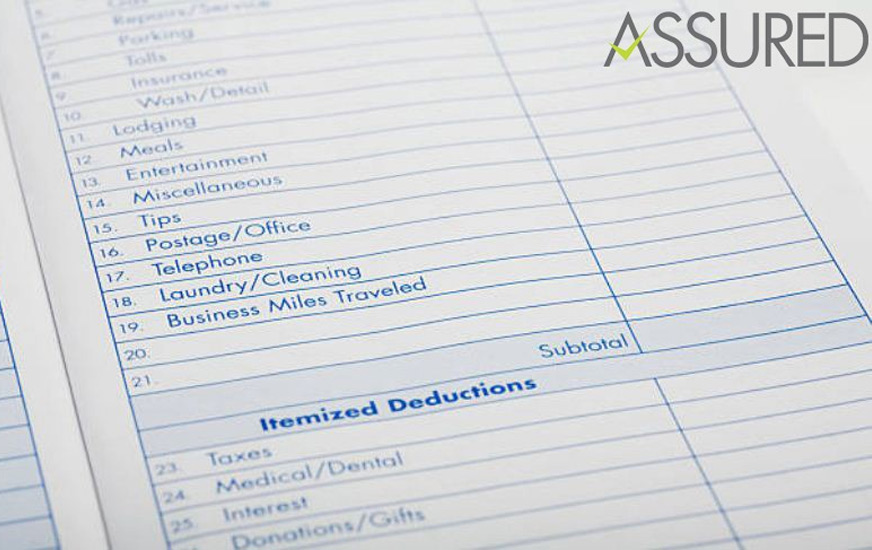

Tax Cuts and Jobs Act, also known as TCJA, has made several changes to the existing tax code. The standard deduction has nearly doubled resulting a large reduction to those who itemize their deductions...

April is not the only month that many Americans become concerned about filing as the importance of needing to pay your taxes continues throughout the year. Your payroll reductions, medical bills...

Managing your personal business has a multitude of benefits, including the knowledge and ability to create your own schedule and choose your own clients. A downside, however, that many first-time...

The holiday season may be over, but now it's time to focus on the quickly approaching tax season. Many people tend to wait until the last minute to file their taxes, which is always something that we advise...

Tax planning is a simple way of reshuffling your income smarty without facing any law sickles regulating taxation imposed by the government.In this planning, one can arrange his financial expenses transactions profit...

Amidst this too much of business start-ups gearing up, there is a sheer need of a well managed wealth management. If a company wants to be making profit on a long run, it has to keep updating their whole set of cash flow...

The ultimate goal behind outsourcing your company's bookkeeping operations is to make finances as easy and stress-free as possible. Hiring accounting experts to create your business' own accounting department is often very expensive...

Keeping track of money and watching where every cent is spent can quickly become exhausting, tedious, and overwhelming. Our entire lives revolve around money, which is why it's so important that we know where it's being spent and how...