Did you or someone you know receive a letter from the IRS indicating that your tax return has been selected for audit? Each year, IRS audits over 1 million tax returns. With agency resources shrinking, the IRS is more selective when choosing tax returns to audit. Knowing what the IRS is looking for can help you understand and reduce your audit risk. Here are five of the biggest reasons the IRS may choose to audit your return:

Your income is high or low

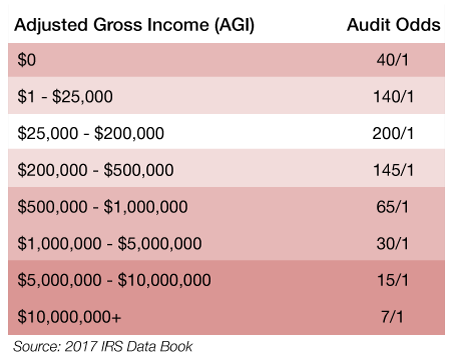

The higher your income, the higher your chances of an audit.

You fail to report all your income

If you earned income as an independent contractor, a form 1099 would have been issued to you and reported to the IRS. The IRS will know that you failed to report income if you accidentally (or intentionally) leave this off of your tax return.

You own a business

Whether you’re claiming travel, entertainment, or any other kind of expense, you must justify a true business purpose for these deductions. If you are your own boss, you might be tempted to hide income by filing personal expenses as business expenses.

You make a math error

Errors in addition or subtraction will likely get caught, even if the mistake is in the favor of the IRS. If your math is a little shaky, using tax preparer near you can help you avoid unfortunate errors.

You claim the Earned Income Tax Credit (EITC)

Due to the complexity of the EITC, the calculation is prone to a lot of errors. According to a report by the U.S. Treasury Department, 24 percent or $16.8 billion in EITC payments were issued improperly in Fiscal Year 2016.

While some of the risk factors are out of your control, many can be minimized. AssuredBATS can help protect your income, negotiate a reasonable IRS payment plan or settlement and provide you freedom from the IRS.If you are in trouble with the IRS, you need Assured Bookkeeping and Tax Service!